|

When it comes to protecting your vehicle and your wallet from unexpected repair costs, Car Mechanical Insurance is a wise choice. In this article, we'll delve into the details of Car Mechanical Insurance, its benefits, and why it's crucial for every car owner.

Understanding Car Mechanical Insurance:

Car Mechanical Insurance, often referred to as Mechanical Breakdown Insurance (MBI) or Extended Auto Warranty, is a specialized insurance policy designed to cover the cost of unexpected mechanical failures and repairs in your vehicle. Unlike traditional auto insurance, which primarily focuses on accidents and collisions, Car Mechanical Insurance is geared specifically towards covering non-accident-related mechanical breakdowns.

Key Benefits of Car Mechanical Insurance:

Opting for Car Mechanical Insurance offers several advantages:

- Financial Protection: Car repairs can be expensive, and they often come when you least expect them. Mechanical Insurance provides financial protection by covering the repair costs for mechanical failures, saving you from significant out-of-pocket expenses.

- Peace of Mind: Knowing that your vehicle is protected by Car Mechanical Insurance provides peace of mind. You can drive with confidence, knowing that unexpected breakdowns won't disrupt your daily life.

- Quality Repairs: Car Mechanical Insurance ensures that your vehicle is repaired by certified technicians who use genuine manufacturer parts. This guarantees the highest quality of repairs, maintaining the performance and value of your car.

- Rental Car Coverage: Many Car Mechanical Insurance policies include rental car coverage, which means you'll have access to a replacement vehicle while yours is in the shop for repairs.

- Customizable Plans: Car Mechanical Insurance plans are often customizable, allowing you to tailor coverage to your specific needs. You can choose the coverage level, deductible, and duration that suits you best.

How Car Mechanical Insurance Works:

When you purchase Car Mechanical Insurance, you select a coverage plan based on your vehicle's make, model, and age. The policy will specify the duration of coverage and the components or systems that are included. If your vehicle experiences a covered mechanical breakdown during the policy period, the insurance company will cover the repair costs, minus any deductible.

Choosing the Right Car Mechanical Insurance:

Consider the following factors when selecting the right Car Mechanical Insurance plan:

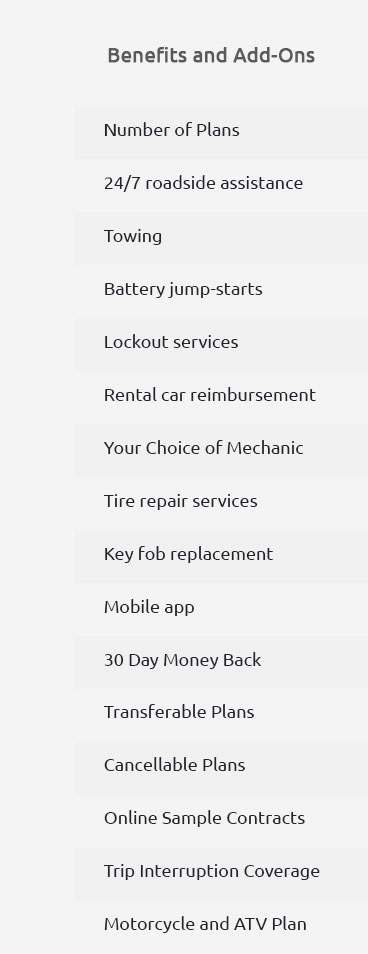

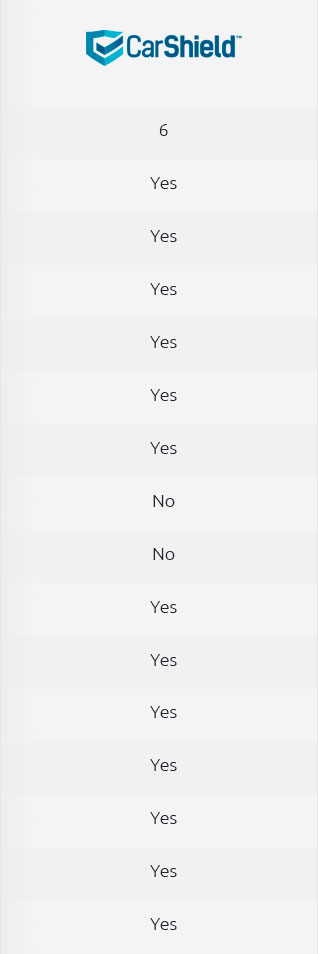

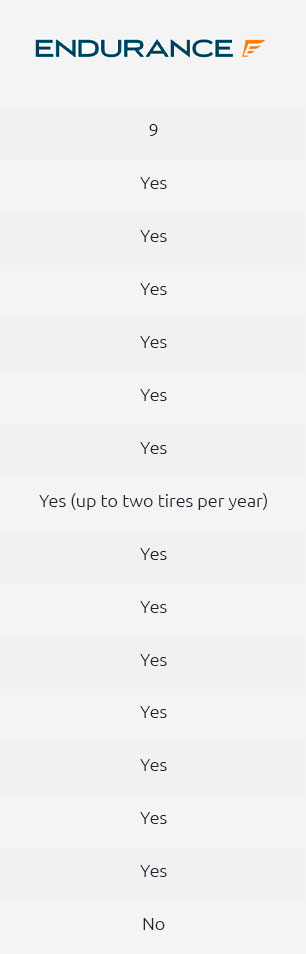

- Coverage Options: Review the available coverage options to ensure they align with your vehicle's needs. Some policies cover specific components, while others offer comprehensive coverage.

- Deductible Amount: Understand the deductible associated with the insurance plan. A higher deductible may result in lower premium costs.

- Provider Reputation: Research and choose a reputable Car Mechanical Insurance provider known for efficient claims processing and excellent customer service.

- Budget Considerations: Evaluate the cost of the insurance plan in relation to your budget and the potential savings on future repairs.

- Policy Duration: Determine how long you plan to keep your vehicle. Choose a policy duration that provides coverage for the desired period.

Conclusion:

Car Mechanical Insurance is an essential safeguard for every car owner, offering financial protection, peace of mind, and quality repairs. By choosing the right insurance plan and tailoring it to your needs, you can enjoy worry-free driving, knowing that your vehicle is covered against unexpected mechanical failures.

|